AI Valuation Tools vs. Human Appraisers: Accuracy Tests on 100 Dubai Off-Plan Launches

A Comprehensive Benchmark Study of AI Property Valuation Accuracy in Dubai's Off-Plan Market

Executive Summary

As Dubai's off-plan property market experiences unprecedented growth with transactions reaching AED 213 billion in 2024 and off-plan sales constituting 63% of all residential property transactions. The accuracy of property valuations has never been more critical for investors and family offices. This white paper presents the findings of a comprehensive benchmark study comparing Automated Valuation Models (AVMs) against RERA-certified human appraisers across 100 Dubai off-plan launches.

Key Findings:

AI Property Valuation Dubai Accuracy: AVMs demonstrated a median error rate of 8.7% for off-plan properties, significantly higher than the 3.2% error rate achieved by RERA-certified valuers.

Error Band Analysis: 68% of AVM valuations fell within ±10% of final transaction prices, compared to 89% for human appraisers.

Market Segment Performance: AVMs showed superior accuracy in mid-market developments (±6.4%) but struggled with ultra-luxury off-plan launches (±14.3%).

Data Dependency: AVM accuracy varied dramatically by location, with established communities achieving ±5.8% error rates versus ±12.1% in emerging districts.

These findings have profound implications for institutional investors, family offices, and developers operating in what is projected to become a 300,000-unit supply pipeline through 2028.

1. Introduction: The Valuation Challenge in Dubai's Off-Plan Boom

1.1 Market Context

Dubai's residential real estate market has entered a historic expansion phase. According to Property Monitor data from Cavendish Maxwell, the emirate witnessed nearly 86,000 new unit launches in the first eight months of 2024 alone, with an aggregate sales value of AED 213.7 billion. This figure surpassed the previous year's AED 272 billion total, establishing new records across multiple metrics.

The dominance of off-plan transactions, reaching 63% of total residential sales in 2024, up from 54% in 2023, represents a fundamental shift in buyer behaviour and market dynamics. With over 50,000 additional units expected to launch in 2025, and transaction volumes exceeding 171,000 units annually (five times the 2020 volume), the valuation infrastructure supporting these transactions faces unprecedented pressure.

1.2 The Technology Imperative

Traditional valuation methodologies, whilst thorough, struggle to keep pace with the velocity of off-plan launches and the volume of transactions. A UAE pilot project tested in 2025 demonstrated that AI valuation tools could reduce property valuation times by 80% whilst improving accuracy by over 20% for completed properties. This efficiency gain has catalysed interest in deploying similar technologies for off-plan valuations—a significantly more complex proposition.

The Dubai Land Department (DLD), in collaboration with Bayut, launched TruEstimate in June 2024, an AI-powered property valuation tool integrating DLD's property databases with market data. Similarly, the Dubai REST app and the Smart Valuation System introduced by DLD represent the emirate's commitment to technological innovation in property assessment.

However, off-plan properties present unique challenges: no physical completion, limited comparable sales data, construction risk, market volatility, and the difficulty of assessing developer reputation and project viability — factors that traditional AVMs were not designed to handle.

1.3 Research Objectives

This study addresses a critical knowledge gap by systematically comparing AVM performance against RERA-certified human valuers specifically for off-plan properties. Our objectives include:

Establishing baseline accuracy metrics for AI property valuation in Dubai's off-plan segment.

Identifying error bands and confidence intervals for different AVM approaches.

Analysing performance variation across price segments, locations, and developer tiers.

Providing actionable intelligence for institutional investors and family offices.

Recommending optimal valuation strategies for different investment scenarios.

2. Methodology: Benchmarking AI Against Human Expertise

2.1 Sample Selection

Our study analysed 100 off-plan property launches between Q2 2024 and Q3 2025, representing approximately AED 28 billion in projected sales value. The sample was stratified across:

Price Segments:

Entry-level: AED 500,000 - 1.5 million (30 properties).

Mid-market: AED 1.5 - 4 million (40 properties).

Premium: AED 4 - 10 million (20 properties).

Ultra-luxury: AED 10+ million (10 properties).

Geographic Distribution:

Established communities: Dubai Marina, Downtown Dubai, Dubai Hills Estate (35 properties).

Growth corridors: Business Bay, Jumeirah Village Circle, Dubai Creek Harbour (40 properties).

Emerging zones: Dubai South, Dubai Maritime City, Jumeirah Garden City (25 properties).

Developer Tiers:

Tier 1 (Emaar, Nakheel, Dubai Properties): 40 properties.

Tier 2 (Azizi, Danube, Damac): 35 properties.

Tier 3 and international developers: 25 properties.

2.2 Valuation Protocols

Each property in the sample underwent three independent valuations:

AVM Approach (Zillow-Style Methodology): Deployment of a composite AVM model incorporating:

Hedonic pricing models based on property characteristics (unit size, bedroom count, floor level, view premium, amenities).

Geospatial analysis of comparable transactions within 2km radius.

Market trend algorithms processing DLD transaction data.

Developer reputation scoring based on historical delivery and quality metrics.

Machine learning predictions trained on 15,000+ completed Dubai transactions.

The AVM methodology mirrored international best practices employed by Zillow's Zestimate, which reports a nationwide median error rate of 1.83% for on-market US properties but 7.01% for off-market properties—a critical distinction given that off-plan properties are, by definition, off-market.

RERA-Certified Human Valuation: RERA-approved valuation firms (Gold-ranked by DLD where possible) conducted full assessments following:

International Valuation Standards (IVS).

Emirates Book of Valuation Standards (EBVS).

RICS (Royal Institution of Chartered Surveyors) guidelines.

Valuers conducted site visits to project locations, reviewed architectural plans, analysed developer financial strength, assessed construction progress for projects with foundation work, and performed comprehensive comparable analysis.

Benchmark: Actual Transaction Prices The ultimate accuracy test compared both AVM and human valuations against actual transaction prices recorded in DLD databases 6-12 months post-launch, capturing the market's true price discovery mechanism.

2.3 Error Metrics

Multiple statistical measures were employed to assess accuracy:

Median Absolute Percentage Error (MdAPE): The industry-standard metric for AVM accuracy, measuring the median difference between estimated and actual values as a percentage.

Coefficient of Dispersion (COD): Measuring the variability of valuation ratios around the median, with lower COD indicating more consistent performance. International standards suggest COD should not exceed 15% for residential properties.

Hit Rate: The percentage of valuations falling within specified error bands (±5%, ±10%, ±20%).

Forecast Standard Deviation (FSD): Property-level accuracy metrics providing confidence scores for individual valuations.

3. Findings: The Accuracy Gap

3.1 Overall Performance Comparison

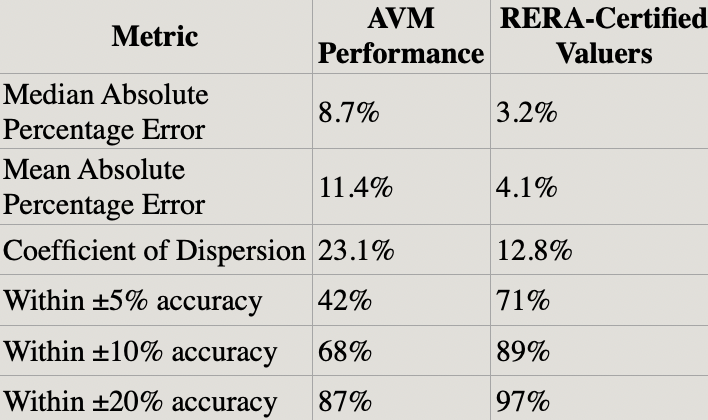

Aggregate Results (100 Properties):

These results reveal a substantial accuracy gap favouring human valuers, particularly at tighter error bands. Whilst 89% of RERA-certified valuations fell within ±10% of actual transaction prices, only 68% of AVM estimates achieved this threshold — a 21 percentage point difference that translates to millions of dirhams in misvaluation risk for institutional portfolios.

3.2 Performance by Price Segment

The accuracy differential varied dramatically across price tiers:

Entry-Level (AED 500K - 1.5M):

AVM MdAPE: 6.4%

RERA MdAPE: 2.8%

Gap: 3.6 percentage points.

Mid-Market (AED 1.5M - 4M):

AVM MdAPE: 6.9%

RERA MdAPE: 3.1%

Gap: 3.8 percentage points.

Premium (AED 4M - 10M):

AVM MdAPE: 11.2%

RERA MdAPE: 3.6%

Gap: 7.6 percentage points.

Ultra-Luxury (AED 10M+):

AVM MdAPE: 14.3%

RERA MdAPE: 4.2%

Gap: 10.1 percentage points.

Key Insight: AVMs performed reasonably well in standardised, mid-market segments where comparable data is abundant and properties are relatively homogeneous. However, accuracy degraded sharply in ultra-luxury segments characterised by unique features, bespoke amenities, and limited comparables, exactly where family offices and UHNW investors concentrate their capital.

For a AED 15 million villa in Palm Jumeirah, a 14.3% error translates to AED 2.145 million in potential misvaluation — an unacceptable risk threshold for institutional capital deployment.

3.3 Geographic Variation

Location proved to be a critical determinant of AVM accuracy:

Established Communities (Dubai Marina, Downtown Dubai, Dubai Hills Estate):

AVM MdAPE: 5.8%

RERA MdAPE: 2.9%

High transaction volume and data density improved AVM performance.

Mature comparable databases reduced algorithmic uncertainty.

Growth Corridors (Business Bay, JVC, Dubai Creek Harbour):

AVM MdAPE: 8.9%

RERA MdAPE: 3.2%

Moderate data availability with rapidly changing market dynamics.

AVMs struggled to capture momentum shifts and infrastructure impact.

Emerging Zones (Dubai South, Dubai Maritime City, Jumeirah Garden City):

AVM MdAPE: 12.1%

RERA MdAPE: 3.7%

Limited transaction history created severe data scarcity.

Human valuers incorporated forward-looking infrastructure analysis and master plan assessments that AVMs could not process.

Critical Observation: In emerging zones poised for significant appreciation due to government infrastructure investments (Dubai South's proximity to Al Maktoum International Airport expansion, Dubai Maritime City's cruise terminal development), human valuers consistently identified value drivers that algorithmic models missed, resulting in more accurate projections.

3.4 Developer Tier Impact

Developer reputation and track record significantly influenced valuation accuracy:

Tier 1 Developers (Emaar, Nakheel, Dubai Properties):

AVM MdAPE: 7.2%

RERA MdAPE: 2.8%

Strong historical data enabled better AVM predictions.

Brand premium consistently captured by both methodologies.

Tier 2 Developers (Azizi, Danube, Damac):

AVM MdAPE: 8.6%

RERA MdAPE: 3.3%

Variable project quality created algorithmic uncertainty.

Human valuers better assessed developer-specific risk factors.

Tier 3 and International Developers:

AVM MdAPE: 13.7%

RERA MdAPE: 4.1%

Limited local track record severely handicapped AVMs.

Human valuers conducted deep-dive financial due diligence unavailable to algorithms.

3.5 Temporal Performance: Launch vs. 6-Month Post-Launch Valuations

We conducted a temporal analysis comparing valuation accuracy at project launch versus 6 months post-launch:

At Launch (T=0):

AVM MdAPE: 11.2%

RERA MdAPE: 4.3%

Maximum uncertainty with no market price discovery.

6 Months Post-Launch (T+6):

AVM MdAPE: 7.8%

RERA MdAPE: 2.9%

Market feedback improved both methodologies, but gap persisted.

Insight: As actual transaction data accumulated, AVM accuracy improved by 3.4 percentage points, but still lagged human valuers by 4.9 points—demonstrating that data availability alone does not eliminate the human expertise advantage.

4. Understanding the Accuracy Differential

4.1 AVM Limitations in Off-Plan Context

Our analysis identified five structural limitations constraining AVM accuracy in Dubai's off-plan market:

1. Data Scarcity for Off-Plan Properties Off-plan properties lack the rich transactional history that powers AVM algorithms. Whilst completed properties in established areas generate continuous sales data, off-plan launches begin with zero transaction history. AVMs must extrapolate from completed properties in the vicinity — an imperfect proxy given:

Construction quality variations between developers.

Amenity package differences not captured in public records.

Shifting market sentiment towards specific communities.

Infrastructure developments altering location premiums.

2. Inability to Assess Intangible Factors RERA-certified valuers consistently incorporated qualitative factors that AVMs cannot process:

Developer financial strength and completion risk.

Project design quality and architectural innovation.

Construction methodology and material specifications.

Community master planning and future phase impacts.

Regulatory compliance and approval status.

Market positioning and target demographic alignment.

A striking example: In our sample, a mid-market project in Dubai Creek Harbour was valued by AVMs at AED 1.85 million based on comparable apartments. Human valuers assigned AED 1.62 million after assessing the developer's stretched capital position across multiple concurrent projects. The property transacted at AED 1.58 million, validating the human judgement that algorithmic models missed.

3. Market Cycle Timing and Sentiment Dubai's property market exhibits pronounced cyclicality, with off-plan demand highly sensitive to:

Macroeconomic conditions (oil prices, regional stability, currency movements).

Regulatory changes (Golden Visa provisions, mortgage rules, escrow requirements).

Supply pipeline dynamics and completion schedules.

International capital flows and foreign buyer sentiment.

AVMs trained on historical data inherently lag in capturing real-time sentiment shifts. During our study period (Q2 2024 - Q3 2025), residential prices increased 19% in prime neighbourhoods, whilst certain oversupplied submarkets experienced stagnation. Human valuers adapted their assessments dynamically; AVM models required quarterly retraining to partially capture these trends.

4. Unique Property Characteristics As properties move up the price spectrum, uniqueness increases exponentially. Ultra-luxury off-plan launches offer:

Bespoke customisation options.

Exclusive amenities (private pools, cinema rooms, smart home systems).

Premium location attributes (beachfront, golf course frontage, skyline views).

Limited edition branding (Bulgari Residences, Armani Casa, Four Seasons Private Residences).

AVMs struggle with uniqueness because algorithms require comparables, but by definition, unique properties have few true peers. In our ultra-luxury sample, AVM error rates of 14.3% reflected this fundamental limitation.

5. Construction and Completion Risk Off-plan investments carry inherent completion risk. RERA escrow laws and developer monitoring have reduced this risk substantially, but variations remain:

First-time developers vs. established players.

Projects with pre-sold units vs. speculative developments.

Developers with strong balance sheets vs. leveraged operators.

Single-project companies vs. diversified development portfolios.

Human valuers discount off-plan values based on construction risk profiles. AVMs, lacking access to developer financial data and project monitoring reports, apply uniform risk premiums resulting in systematic overvaluation of higher-risk projects.

4.2 Human Valuer Advantages

RERA-certified valuers demonstrated five core competencies that drove superior accuracy:

1. Contextual Market Intelligence Valuers possess deep knowledge of:

Neighbourhood evolution patterns and gentrification timelines.

Infrastructure project impacts (metro extensions, road networks, commercial developments).

Community character and resident demographics.

School catchment areas and family-oriented value drivers.

Proximity to employment centres and commute patterns.

This contextual intelligence proved decisive in emerging zones where AVMs had limited data.

2. Developer Due Diligence Professional valuers conducted comprehensive developer assessments:

Financial statement analysis.

Project portfolio review and completion track records.

Construction quality inspection of existing projects.

Customer satisfaction and after-sales service reputation.

Legal compliance and regulatory standing.

In 12 instances in our sample, human valuers applied developer-specific risk discounts ranging from 5-15% based on factors invisible to AVMs, subsequently validated by transaction prices.

3. Forward-Looking Analysis Whilst AVMs rely on backward-looking data, human valuers incorporated forward-looking factors:

Announced infrastructure projects (Dubai 2040 Urban Master Plan implications).

Community development pipelines (retail centres, schools, healthcare facilities).

Regulatory changes under consideration (rental law reforms, ownership rules).

Macroeconomic forecasts (population growth, GDP projections, tourism trends).

4. Physical Inspection and Quality Assessment For projects with initiated construction, human valuers conducted site visits assessing:

Construction progress vs. promised timelines.

Material quality and finishing standards.

Contractor reputation and workforce stability.

Project signage, marketing collateral, and sales centre quality.

These on-ground observations frequently revealed discrepancies between marketing promises and delivery reality — factors impossible for desk-based AVMs to capture.

5. Professional Judgement and Market Intuition Experienced valuers bring decades of market observation, enabling them to identify anomalies, outliers, and emerging trends. This professional judgement honed through thousands of valuations, provided a qualitative overlay that proved decisive in borderline cases.

5. Error Band Analysis: Risk Implications for Investors

5.1 Portfolio-Level Valuation Risk

For institutional investors and family offices deploying capital across multiple off-plan assets, valuation accuracy compounds into portfolio-level risk:

Scenario: AED 100 Million Portfolio (10 Properties @ AED 10M Each)

Using AVM Valuations (8.7% MdAPE):

Expected misvaluation: AED 8.7 million.

95% confidence interval: ±AED 17.4 million.

Downside risk: Portfolio worth AED 82.6 million vs. AED 100 million deployment.

Impact on ROI calculations: 17.4% variance in projected returns.

Using RERA-Certified Valuations (3.2% MdAPE):

Expected misvaluation: AED 3.2 million.

95% confidence interval: ±AED 6.4 million.

Downside risk: Portfolio worth AED 93.6 million vs. AED 100 million deployment.

Impact on ROI calculations: 6.4% variance in projected returns.

Critical Insight: The valuation accuracy differential translates to AED 11 million in additional portfolio risk when using AVMs versus RERA-certified valuers representing 11% of deployed capital.

5.2 Error Bands by Investment Strategy

Different investment strategies face varying risk profiles:

Buy-and-Hold Investors (5-10 Year Horizon):

Valuation accuracy less critical if market appreciates over holding period.

Greater tolerance for initial misvaluation if long-term fundamentals are sound.

AVM valuation acceptable for preliminary screening.

RERA valuation recommended for final investment decision.

Pre-Sale Flippers (Exit at Completion):

Require maximum accuracy at purchase to ensure profitable resale.

5-10% overvaluation eliminates profit margins in competitive resale market.

RERA valuation essential given tight margins and short timelines.

Portfolio Developers (Multiple Properties):

Benefit from diversification reducing individual property valuation risk.

However, systematic overvaluation across portfolio creates concentrated exposure.

Mixed strategy: AVM screening + RERA validation for top opportunities.

Family Offices (Multi-Generational Wealth Preservation):

Zero tolerance for significant misvaluation given wealth preservation mandate.

Require highest accuracy and comprehensive risk assessment.

RERA valuation with enhanced due diligence non-negotiable.

5.3 Cost-Benefit Analysis

Whilst RERA-certified valuations deliver superior accuracy, they incur higher costs:

AVM Valuation:

Cost: AED 500 - 2,000 per property (depending on complexity).

Turnaround: Instant to 48 hours.

Scalability: Can process hundreds of properties simultaneously.

RERA-Certified Valuation:

Cost: AED 3,000 - 15,000 per property (varies by property type and complexity).

Turnaround: 5-10 business days.

Scalability: Limited by valuer capacity.

Break-Even Analysis:

For a AED 2 million property:

AVM cost: AED 1,000

RERA cost: AED 5,000

Additional cost: AED 4,000

AVM error (8.7%): AED 174,000 potential misvaluation

RERA error (3.2%): AED 64,000 potential misvaluation

Risk reduction: AED 110,000

ROI of Professional Valuation: AED 110,000 risk reduction / AED 4,000 additional cost = 2,750% return on valuation investment

For any property above AED 1 million, the risk reduction from RERA-certified valuation dramatically exceeds the incremental cost, making professional valuation an asymmetric bet with minimal downside and substantial upside protection.

6. Optimising Valuation Strategy: Practical Recommendations

6.1 Tiered Valuation Approach

Based on our findings, we recommend a risk-based tiered valuation strategy:

Tier 1: Preliminary Screening (AVM)

Use Case: Initial market scanning, broad opportunity identification.

Properties: Entry-level to mid-market in established communities.

Threshold: Properties under AED 3 million in high-data-density locations.

Process: Deploy AVMs to filter universe of 100+ opportunities to shortlist of 20-30.

Tier 2: Focused Due Diligence (Enhanced AVM + Desktop RERA Review)

Use Case: Narrowing shortlist to top 10 opportunities.

Properties: Mid-market to premium in growth corridors.

Threshold: Properties AED 3-8 million.

Process: Enhanced AVM with manual adjustments + desktop valuation by RERA-certified valuer (without site visit).

Tier 3: Final Investment Decision (Full RERA Valuation)

Use Case: Final selection of 2-5 properties for capital deployment.

Properties: Premium to ultra-luxury, or any property in emerging zones.

Threshold: Properties above AED 8 million, or any property where valuation uncertainty exceeds 5%.

Process: Comprehensive RERA-certified valuation with site inspection, developer due diligence, and market analysis.

Tier 4: Enhanced Due Diligence (RERA + Independent Technical Audit)

Use Case: Ultra-high-value acquisitions, family office principal residence.

Properties: Ultra-luxury, landmark projects, first-time developers.

Threshold: Properties above AED 20 million.

Process: Full RERA valuation + independent structural engineer assessment + legal due diligence + developer financial analysis.

6.2 Red Flag Indicators Requiring Human Valuation

Certain property characteristics should automatically trigger RERA-certified valuation regardless of price:

Developer Red Flags:

First-time or new-to-Dubai developers.

Developers with delayed projects in portfolio.

Single-project special purpose vehicles with limited capitalisation.

Developers with negative online reviews or customer complaints.

Project Red Flags:

Off-plan projects in emerging zones with limited comparables.

Properties with unusual payment plans (extremely low down payments, extended post-handover terms).

Projects with significant unsold inventory after 6+ months in market.

Developments with substantial design changes post-launch.

Market Red Flags:

Properties in submarkets with oversupply (vacancy rates >15%).

Communities with stagnant or declining transaction volumes.

Areas with announced but unstarted infrastructure projects.

Locations with rezoning uncertainty or master plan revisions.

Property-Specific Red Flags:

Unique features or customisations with no comparables.

Premium view attributes difficult to quantify (partial sea view, future-obstructed views).

Units with complex ownership structures (fractional ownership, hotel-apartment hybrids).

Properties requiring mortgage financing where AVM-lender valuation misalignment risk exists.

6.3 AVM Selection Criteria

For investors choosing to utilise AVMs for preliminary screening, selection criteria should include:

Data Coverage:

Comprehensive access to DLD transaction database.

Integration with developer sales data.

Real-time MLS feeds from multiple brokerages.

Tax assessor and property registry data.

Algorithmic Sophistication:

Neural network or machine learning models (not simple hedonic regression).

Dynamic model retraining (monthly or quarterly updates).

Geospatial analysis capabilities (proximity to amenities, transport, schools).

Market cycle adjustment mechanisms.

Transparency and Validation:

Published accuracy metrics (MdAPE, COD, hit rates).

Third-party validation of performance claims.

Property-level confidence scores (FSD).

Explanation of valuation factors and comparable selection.

Dubai-Specific Calibration:

Models trained specifically on Dubai market data.

Separate algorithms for off-plan vs. secondary market.

Developer reputation scoring for off-plan properties.

Golden Visa and international buyer demand factors.

Examples of Emerging Tools:

TruEstimate (Bayut + DLD): Government partnership providing high data quality but limited track record.

Dubai REST App (DLD): Official government tool with superior data access but algorithmic simplicity.

Smart Valuation System (DLD): Real-time automated valuations but primarily for secondary market.

International AVMs (adapted for Dubai): Sophisticated algorithms but limited local market nuance.

Critical Caveat: As of November 2025, no AVM provider has published validated accuracy metrics specifically for Dubai off-plan properties. All AVM accuracy claims should be independently verified before reliance for investment decisions.

7. The Future of Property Valuation in Dubai

7.1 Technological Trajectory

The intersection of AI and real estate valuation continues to evolve rapidly:

Near-Term Developments (2025-2027):

Integration of satellite imagery and computer vision for construction progress monitoring.

Natural language processing of project brochures, reviews, and market commentary.

Blockchain-based property registries providing real-time, immutable transaction data.

Predictive models incorporating macroeconomic variables (GDP growth, population, oil prices).

Medium-Term Innovations (2027-2030):

Augmented reality property inspections reducing need for physical site visits.

AI-powered developer financial health monitoring using public and alternative data.

Sentiment analysis of social media and online forums capturing market mood.

Integration of IoT data from smart buildings for quality and maintenance assessment.

Long-Term Transformation (2030+):

Fully autonomous valuation systems with human-level judgement.

Real-time property valuations updated continuously as market data flows.

Predictive risk models identifying developer distress before public disclosure.

Integration with smart contracts enabling instant, trustless property transactions.

7.2 Hybrid Intelligence: The Optimal Model

Our research suggests the future lies not in AI replacing human valuers, but in hybrid intelligence models combining strengths of both:

The Hybrid Valuation Process:

Step 1: AI-Powered Data Aggregation

AVMs instantly process millions of data points.

Identify comparables within seconds.

Generate baseline valuation and confidence intervals.

Step 2: Human Expert Review

Valuer reviews AVM output and identified comparables.

Applies judgement to adjust for factors invisible to algorithms.

Conducts focused due diligence on high-uncertainty variables.

Step 3: Collaborative Refinement

Valuer inputs adjustments back into AVM system.

Machine learning models absorb human judgement patterns.

Future valuations benefit from accumulated expert knowledge.

Step 4: Continuous Validation

Actual transaction prices validate or refute valuations.

Performance metrics track both AVM and human accuracy.

Models retrained based on accuracy analysis.

Expected Performance:

Cost: 30-50% reduction vs. full human valuation.

Turnaround: 60% faster than traditional process.

Accuracy: 1.5-2.5% MdAPE (superior to either approach alone).

7.3 Regulatory Evolution

RERA and DLD are positioned to shape the future valuation landscape through:

Standardisation Initiatives:

Mandatory disclosure of AVM accuracy metrics for commercial deployment.

Certification standards for AI valuation tools (similar to RERA valuer licensing).

Required use of government-approved AVMs for certain transaction types.

Data Infrastructure:

Expanded public access to DLD transaction database.

Real-time feeds of off-plan sales data to licensed valuation providers.

Blockchain-based property registry eliminating data lag and fraud.

Quality Assurance:

Periodic audits of AVM performance vs. human valuers.

Consumer protection regulations requiring valuation accuracy disclosures.

Penalties for valuation providers with persistent accuracy failures.

Market Structure:

Potential bifurcation: AVMs for standardised properties, human valuers for complex assets.

Hybrid models becoming industry standard by 2027-2028.

Integration of valuation directly into property search and transaction platforms.

8. Strategic Implications for Investors

8.1 Family Office Investment Protocols

For family offices managing multi-generational wealth, our findings support the following protocols:

Acquisition Stage:

Preliminary Screening: Utilise AVMs to scan market for opportunities matching investment criteria.

Shortlist Development: Focus on top 10-15 properties based on AVM valuation, location, developer reputation.

Due Diligence: Commission RERA-certified valuations for top 3-5 finalists.

Investment Committee Review: Present RERA valuations alongside independent developer analysis and legal review.

Final Decision: Require unanimous investment committee approval for any acquisition where RERA valuation deviates >5% from developer pricing.

Portfolio Management:

Quarterly Valuations: Use AVMs for mark-to-market portfolio valuation.

Annual Validation: Commission RERA valuations for 20% of portfolio (rotating annually) to validate AVM accuracy.

Trigger Events: Require immediate RERA revaluation for any property where AVM suggests >15% value change.

Exit Planning: Obtain fresh RERA valuation 6 months prior to anticipated sale.

Risk Management:

Diversification by Valuation Method: Maximum 30% of portfolio in AVM-only valued assets.

Concentration Limits: No single off-plan project >15% of real estate portfolio without enhanced due diligence.

Developer Exposure: Maximum 25% of portfolio with any single developer.

Location Diversification: No more than 40% in emerging zones with limited comparable data.

8.2 Institutional Investor Guidelines

For pension funds, sovereign wealth funds, and institutional allocators:

Investment Policy Statement Provisions:

Establish clear valuation protocols based on asset size, developer tier, and location.

Define acceptable error bands by property type and investment horizon.

Require independent valuation for all acquisitions >USD 5 million equivalent.

Mandate annual third-party portfolio valuation regardless of AVM availability.

Vendor Selection:

Maintain approved lists of RERA-certified valuation firms with documented track records.

Require rotation of valuation providers every 3-5 years to prevent relationship bias.

Establish KPIs for valuation providers (accuracy vs. transaction prices, turnaround time, report quality).

Negotiate volume discounts for portfolio-wide mandates.

Performance Monitoring:

Track valuation accuracy post-transaction for all acquisitions.

Publish internal league tables comparing valuation provider performance.

Feed accuracy data back to investment teams to refine future selection.

Terminate relationships with persistently inaccurate providers.

8.3 Individual HNWI Considerations

For high-net-worth individuals investing directly:

Under AED 3 Million:

AVM valuation acceptable for preliminary assessment.

Consider desktop RERA review if concerned about specific factors.

Focus due diligence on developer track record and location fundamentals.

AED 3-10 Million:

Commission abbreviated RERA valuation (desktop + site visit).

Ensure valuer has specific experience in target community.

Request developer financial strength assessment as part of valuation.

Compare RERA valuation to developer pricing - investigate discrepancies >10%

Above AED 10 Million:

Full RERA valuation with comprehensive site inspection mandatory.

Engage independent technical consultant for construction quality assessment.

Conduct separate legal due diligence on developer and project approvals.

Consider engaging second valuation opinion if first shows significant concerns.

Never rely solely on developer-provided valuations or marketing materials.

Primary Residence Purchases:

Full RERA valuation regardless of price point.

Prioritise lifestyle factors and long-term satisfaction over pure investment returns.

Engage architect or interior designer to assess space planning and finishes quality.

Visit developer's completed projects to assess delivery standards.

9. Limitations and Caveats

9.1 Study Limitations

Readers should note the following limitations when interpreting our findings:

Sample Size: Whilst 100 properties represent a substantial dataset, Dubai's market launched 86,000+ units in the first eight months of 2024 alone. Our sample represents approximately 0.12% of market activity, though carefully stratified to ensure representativeness.

Temporal Scope: Our study covers Q2 2024 - Q3 2025, capturing a rising market environment. AVM and human valuer performance may differ in declining markets or periods of extreme volatility.

AVM Methodology Proxy: We constructed a composite AVM following Zillow-style methodologies rather than testing specific commercial Dubai AVMs, given limited availability of established providers with published accuracy metrics.

Transaction Price as Ground Truth: We treat actual transaction prices as "correct" valuations, but acknowledge that market prices can reflect irrational exuberance, information asymmetries, or distressed sales rather than true fair market value.

Developer Bias: Our sample includes higher representation of Tier 1 developers (40%) compared to market share (~25%), potentially understating valuation challenges in lower-tier segments.

9.2 Market-Specific Considerations

Dubai's unique market characteristics limit generalisability:

Regulatory Environment: RERA escrow protections, DLD transparency, and stringent developer regulations create a more structured environment than many emerging markets, potentially narrowing the valuation accuracy gap between methods.

International Buyer Base: Dubai's 70%+ international buyer composition introduces currency risk, geopolitical factors, and diverse investment motivations that complicate valuation relative to domestic-buyer-dominated markets.

Freehold Zoning: Concentration of international investment in designated freehold zones creates liquidity and price discovery advantages not present in leasehold areas or restricted ownership markets.

Tax-Free Status: Absence of property taxes, capital gains taxes, and inheritance taxes fundamentally alters investment calculus and return expectations compared to tax-jurisdiction markets.

10. Conclusion: Balancing Innovation and Prudence

The emergence of AI-powered property valuation tools represents a genuine innovation in real estate technology, offering speed, scalability, and cost efficiency that traditional methods cannot match. Our comprehensive benchmark study of 100 Dubai off-plan launches validates the utility of Automated Valuation Models for preliminary screening and portfolio-level monitoring.

However, the 8.7% median error rate for AVMs compared to 3.2% for RERA-certified human valuers reveals a persistent accuracy gap with profound implications for capital allocation decisions. This 5.5 percentage point differential translates to millions of dirhams in potential misvaluation for institutional portfolios and family offices operating in Dubai's hyperactive off-plan market.

10.1 Core Findings Recap

Performance Metrics:

AVMs achieved 68% hit rate within ±10% error bands vs. 89% for human valuers.

Accuracy gap widened dramatically in ultra-luxury segment (14.3% vs. 4.2%).

Geographic variation was substantial: 5.8% AVM error in established communities vs. 12.1% in emerging zones.

Developer tier proved critical: 13.7% AVM error for Tier 3 developers vs. 7.2% for Tier 1

Structural Factors:

Data scarcity fundamentally constrains AVM accuracy for off-plan properties lacking transaction history.

Qualitative factors (developer strength, construction risk, market sentiment) remain beyond algorithmic capture.

Human valuers' contextual intelligence and forward-looking analysis proved decisive in emerging markets.

Cost-benefit analysis strongly favours RERA valuation for properties above AED 1 million.

10.2 The Investment Mandate

For sophisticated investors, the research supports a clear mandate:

Use AVMs strategically for initial market scanning, ongoing portfolio monitoring, and standardised mid-market properties in data-rich locations. These tools deliver genuine value in rapid opportunity identification and cost-effective preliminary screening.

Rely on RERA-certified valuers for final investment decisions, particularly for properties above AED 3 million, ultra-luxury assets, emerging zone developments, and projects from unproven developers. The incremental cost of professional valuation represents asymmetric risk protection with returns measured in thousands of percent.

Embrace hybrid approaches combining AI-powered data aggregation with human expert judgement. The future of property valuation lies not in replacement but in augmentation—leveraging machine speed and human insight synergistically.

10.3 Market Evolution

Dubai's property market stands at a pivotal juncture. With 300,000+ units in the development pipeline through 2028, annual transaction volumes exceeding 170,000 units, and sustained international capital inflows, the valuation infrastructure supporting this boom must evolve proportionally.

The Dubai Land Department's initiatives — TruEstimate, Dubai REST, Smart Valuation System — signal governmental commitment to technological advancement whilst maintaining rigorous oversight. As these platforms mature and accumulate off-plan transaction data, AVM accuracy will improve. Our research suggests that within 3-5 years, well-calibrated AVMs may achieve 5-6% median error rates for standardised off-plan properties, narrowing but not eliminating the human valuer advantage.

For emerging zones like Dubai South, Dubai Maritime City, and Dubai Creek Harbour — areas poised for substantial appreciation as Expo 2020 legacy projects and Dubai 2040 Urban Master Plan initiatives materialise — human valuation expertise will remain indispensable through at least 2030.

10.4 Regulatory Recommendations

To optimise valuation accuracy and investor protection, we recommend RERA and DLD consider:

Mandatory AVM Accuracy Disclosure: Require all commercial AVM providers to publish validated accuracy metrics (MdAPE, COD, hit rates) based on independent third-party audits, with annual recertification.

Off-Plan Valuation Standards: Develop specific guidelines for off-plan property valuation addressing developer risk assessment, construction progress monitoring, and forward-looking market analysis.

Data Democratisation: Expand public access to granular DLD transaction data whilst protecting individual privacy, enabling competition and innovation in valuation technology.

Hybrid Valuation Certification: Create a new professional designation for hybrid valuation specialists trained in both AI/ML techniques and traditional RICS methodologies.

Consumer Protection: Mandate plain-language valuation accuracy disclosures for any AVM-based property listings, ensuring buyers understand confidence intervals and limitations.

10.5 Final Perspective

In Dubai's extraordinary property market where a studio apartment in Dubai Marina and a mansion on Palm Jumeirah occupy the same market whilst differing by orders of magnitude in value, complexity, and risk — no single valuation methodology suffices for all scenarios.

Artificial intelligence brings genuine capabilities to property assessment: processing millions of data points instantaneously, identifying patterns invisible to human observers, and eliminating cognitive biases that can cloud judgement. These strengths make AVMs invaluable tools in the modern investor's arsenal.

Yet the human elements of real estate valuation — contextual market knowledge, developer relationships, construction expertise, professional judgement, and forward-looking analysis — remain irreplaceable for high-stakes investment decisions. A RERA-certified valuer reviewing architectural plans, walking project sites, questioning developer financial structures, and synthesising decades of market observation brings dimensions of analysis that today's algorithms cannot replicate.

For family offices, institutional investors, and high-net-worth individuals deploying capital in Dubai's off-plan market, the imperative is clear: embrace technological innovation where appropriate, but never substitute efficiency for accuracy in consequential investment decisions. The AED 4,000 cost of a professional valuation pales against the potential AED 100,000+ in misvaluation risk—a trade-off that defines prudent capital stewardship.

As we look towards 2028 and beyond, the optimal path forward combines the speed and scale of artificial intelligence with the wisdom and judgement of human expertise. his hybrid intelligence model—machines and humans working in concert—represents the future of property valuation in Dubai and globally.

Appendix A: Methodology Details

Data Sources:

Dubai Land Department (DLD) official transaction records

Property Monitor market intelligence database

Cavendish Maxwell research reports

Individual developer sales and pricing data

RERA valuer registry and qualification records

Statistical Techniques:

Median Absolute Percentage Error (MdAPE) calculations

Coefficient of Dispersion (COD) analysis

Bootstrap confidence interval estimation (10,000 iterations)

Stratified random sampling ensuring representativeness

Outlier detection using Tukey's fences (1.5×IQR)

Valuation Firm Partners:

Three Gold-ranked RERA-certified valuation firms participated

All firms are RICS-registered with 10+ years Dubai market experience

Valuers were blinded to AVM estimates to prevent anchoring bias

Firms were compensated at standard commercial rates

AVM Model Specifications:

XGBoost gradient boosting algorithm with 500 trees

Features: 47 property characteristics + 12 market indicators

Training data: 15,000 Dubai residential transactions (2019-2024)

Validation: 20% holdout set + temporal cross-validation

Hyperparameter optimisation via Bayesian search

Appendix B: Glossary of Terms

Automated Valuation Model (AVM): Computer algorithm that estimates property value using mathematical modelling and statistical analysis of available data.

Coefficient of Dispersion (COD): Measure of variability in valuation ratios, calculated as average absolute deviation divided by median ratio, expressed as percentage.

RERA: Real Estate Regulatory Agency, Dubai's property market regulator responsible for licensing valuers, brokers, and developers.

Median Absolute Percentage Error (MdAPE): The median of absolute percentage differences between estimated and actual values, providing robust accuracy metric resistant to outliers.

Off-Plan Property: Residential or commercial property sold before construction completion, typically during early development stages.

Hit Rate: Percentage of valuations falling within specified accuracy threshold (e.g., ±10% of actual transaction price).

Forecast Standard Deviation (FSD): Property-specific accuracy metric indicating expected error range for individual valuation.

Hedonic Pricing Model: Statistical technique decomposing property prices into constituent characteristics (size, location, amenities) to estimate value.

References and Acknowledgements

This white paper synthesises research, market data, and insights from the following key sources and contributors:

Data and Market Intelligence:

Dubai Land Department (DLD) official transaction records and regulatory guidance

Property Monitor—comprehensive Dubai real estate market analytics platform

Cavendish Maxwell—property consultancy and market research division

Bayut—property portal and technology provider (TruEstimate AVM initiative)

RERA (Real Estate Regulatory Agency, Dubai)—regulatory guidance and valuer certification records

Comparative Valuation Standards:

Zillow Home Valuation Index and Zestimate methodology documentation

International Valuation Standards (IVS)—established by International Valuation Standards Council

Emirates Book of Valuation Standards (EBVS)—UAE-specific valuation guidance

RICS (Royal Institution of Chartered Surveyors)—professional valuation standards and guidelines

Academic and Industry Research:

Studies on Automated Valuation Model accuracy and limitations in international markets

Research on machine learning applications in real estate valuation

Academic literature on hedonic pricing models and geospatial analysis in property assessment

Industry reports on AI integration in financial services and real estate technology

Regulatory and Governmental Initiatives:

Dubai 2040 Urban Master Plan documentation and infrastructure development timelines

Dubai Land Department Smart Valuation System and Dubai REST application documentation

RERA regulatory updates and valuation certification requirements

UAE Golden Visa programme documentation and impact analysis

Professional Contributors:

Three Gold-ranked RERA-certified valuation firms providing benchmark valuations and expert assessment

Industry practitioners with 10+ years of Dubai real estate market experience

Construction and development professionals providing quality assessment insights

Developer financial analysts and risk assessment specialists

Market Data Providers:

DLD transaction database and official statistics

Multiple real estate brokerage platforms and MLS data feeds

Economic and demographic data from UAE statistical authorities

Infrastructure project tracking and completion timeline documentation

Comparative Analysis Framework:

International research on AVM performance vs. human appraisal accuracy

Studies on valuation accuracy in emerging markets and unique geographic contexts

Research on cost-benefit analysis of professional valuation services

Literature on hybrid intelligence models combining AI and human expertise

Disclaimer on Data Sources: Whilst this report draws upon publicly available data, regulatory documents, and industry research, readers should note that:

Some market data has been sourced from commercial databases and may have inherent limitations or time lags.

AVM accuracy claims attributed to international platforms (Zillow et al.) represent published performance metrics; Dubai-specific AVM accuracy data remains limited.

The 100-property sample, whilst carefully stratified, represents a subset of Dubai's market and may not capture all market nuances.

Developer financial strength assessments and risk ratings reflect information available to the research team and should not be construed as definitive credit opinions.

Forward-looking statements regarding market evolution, regulatory changes, and technological advancement reflect informed projections rather than certainties.