Dubai’s Branded-Residence Boom: 2025 Outlook

1 | Executive snapshot

13 000 + branded units sold in 2024 (≈ AED 60 bn; +43 % y/y).

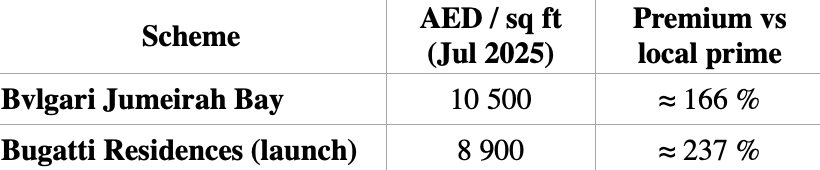

Price premiums average 40–60 %; flagship labels (Bugatti, Bvlgari) fetch 160 %-plus.

Pipeline ≈ 140 schemes by 2031—largest of any global hub.

Savills forecasts 8–10 % capital growth for the prime/branded tier through 2025.

Dubai is set to host ≈ 40 % of all MEA branded stock by 2031.

2 | Timeline: pioneers to powerhouses

Sources: Arabian Business, Kanebridge News, developer announcements

3 | Market size & demand drivers

Tail-winds

Golden Visa (10-yr residency for AED 2 m+) attracts HNWIs.

Tax neutrality & 100 % foreign ownership in most freehold zones.

Lifestyle arbitrage: turnkey hotel services + brand cachet at ~60 % discount to Miami or London stock.

4 | Who buys & why (Q2 2025)

Leading Cohorts Trend

UK & Irish buyers now top the table, +56 % q/q as sterling strength meets Dubai tax perks.

Indian & Pakistani investors hold 2nd-3rd spots, diversifying overseas portfolios.

Russian demand cools but remains significant in ultra-prime villa stock.

5 | Premium mechanics

Headline uplift: ≈ 42 % city-wide; waterfront icons >100 %.

Betterhomes Q2 2025 update

6 | Brand typologies (share of active Dubai schemes)

Morgan’s Intl. Realty H1-2025

7 | Future supply map (delivery ≤ 2031)

*≈ 27 000 units across ~140 projects slated.

8 | Design & amenity trends to 2027

Wellness-first shells (circadian lighting, recovery suites)

Collectible “gallery” garages in automotive towers

Hybrid hospitality decks morphing from co-working to cocktail lounge

Net-zero alignment—LEED-Gold shells & solar façades

9 | Financing landscape

LTV caps: UAE banks limit off-plan luxury to ≤ 50 %—yet 65 % of H1 2025 branded deals were cash.

Typical payment plans: 70/30 or 60/40 tied to milestones; 2-yr post-handover grace common.

Fractional ownership emerging (tickets from USD 275 k; projected 8 % yield).

10 | Regulation snapshot

11 | Risk matrix & mitigations

12 | Global benchmarking (price / sq ft, Jul 2025)*

*FX conversions at 1 USD = AED 3.6725; 1 GBP = AED 4.65.

13 | Strategic take-aways

Liquidity edge – branded homes exit ≈ 1.5 × faster than non-branded.

Premium ≠ guaranteed profit – stick to globally recognised labels with resale history.

Early-bird upside – new island master-plans (Palm Jebel Ali) targeting 15-20 % launch-to-handover uplift.

End-user ballast – >50 % of 2024 buyers intend to occupy, keeping speculation contained.

References

Market & consultancy reports

Savills – Branded Residences: Middle East & Africa 2025 (June 2025).

https://www.savills.co.uk/services/consultancy/global-residential-development-consultancy/branded-residences--middle-east-and-africa-2025.aspx savills.co.uk

Savills – Branded Residences 2024/2025 – Global Outlook (Dec 2024).

https://www.savills.com/blog/article/219392-1/vietnam-eng/branded-residences-2024-2025.aspx savills.comSavills News – “Dubai sees ten-fold surge in AED 10 m+ home sales” (20 Jun 2025).

https://www.savills.us/insight-and-opinion/savills-news/353263/dubai-sees-tenfold-surge-in-aed-10m--home-salessavills.usKnight Frank – Destination Dubai: Key Insights 2025 (May 2025).

https://www.knightfrank.com/research/report-library/destination-dubai-key-insights-2025-12212.aspxknightfrank.comKnight Frank – Dubai Residential Market Review – Q1 2025 (PDF, Apr 2025).

https://content.knightfrank.com/research/2364/documents/en/dubai-residential-market-review-q1-2025-12222.pdfKnight FrankMorgan’s International Realty – Dubai Branded Residences Report – H1 2024 (Aug 2024).

https://www.morgansrealty.com/report/dubai-branded-residences-h1-2024 Morgans RealtyBetterhomes – Q2 2025 Dubai Residential Real Estate Market Report (Jul 2025).

https://www.bhomes.com/en/blog/market-reports/q2-2025-dubai-residential-real-estate-market-report Betterhomes

News & press articles

Arabian Business – “Dubai real estate: Branded-residence sales surge 43 % to generate $16.3 bn in 2024” (30 Jun 2025).

https://www.arabianbusiness.com/industries/real-estate/dubai-real-estate-branded-residences-sales-surge-43-to-generate-16-3bn-in-2024 Arabian BusinessKanebridge News – “Devmark & Prime Marina launch UAE’s first Autograph Collection Residences at Dubai Marina” (11 Jun 2025).

https://kanebridgenewsme.com/devmark-and-prime-marina-launch-uaes-first-autograph-collection-residences-at-dubai-marina/ Kanebridge News Middle East

Regulation & official data

Government of Dubai – Law No. (8) of 2007 Concerning Escrow Accounts for Real Estate Development in the Emirate of Dubai (Official Gazette, 30 Jul 2007).

https://dlp.dubai.gov.ae/Legislation%20Reference/2007/Law%20No.%20(8)%20of%202007.pdf dlp.dubai.gov.aeDubai Land Department – Open-Data Portal: Real-Estate Transactions & Price Indices (accessed 29 Jul 2025).

https://dubailand.gov.ae/en/open-data/