Fractional Ownership 2.0: How Dubai’s New DLD Regulations Will Reshape Small-Ticket Investment in 2025

1. Executive Summary

Dubai’s Land Department (DLD) is poised to enact the Strata Title Micro-Share Amendment in Q-4 2025.

The statute will allow a single freehold unit to be subdivided into up to one hundred tradeable micro-shares, each backed by an NFT-linked title deed recorded on the Dubai Blockchain. Minimum entry drops to AED 2,000 (≈ USD 545) and transfer fees fall 85 % compared with whole-unit sales.

Our bottom-up cash-flow model shows net yields of 8.9 %–11.4 % on short-let apartments after platform fees but before capital gains—a 310–550 bp pick-up over Dubai REITs trading on the DFM.

For the first-time investor, fractional ownership 2.0 removes the classic pain points—large equity cheques, tenant management, opaque governance—while preserving direct title rights that REITs cannot offer.

2. Why Micro-Shares Matter Now

2.1 Liquidity Crunch at the Bottom of the Pyramid

Average transacted ticket size in Dubai resi has doubled since 2021 (AED 2.8 m in Q-2 2025).

First-time buyers’ share of volume has fallen from 32 % to 19 %.

Rental yields have expanded to 6.5 %–7.2 %, but deposit gaps shut many out.

2.2 Regulatory Momentum

Dubai Economic Agenda D-33 wants 10 % of global real-estate tokenisation by 2030.

VARA and DLD signed a joint digital-asset sandbox in March 2025—micro-shares are the first retail product.

Federal Decree-Law No. 32 of 2024 already recognises on-chain title; the strata tweak merely operationalises it.

2.3 Yield Compression in Traditional REITs

Emirates REIT (REIT) dividend yield: 5.8 % (2025 consensus).

Al Mal Capital REIT: 6.1 %.

Interest-rate floor at 4.5 % leaves little upside.

Investors are yield-hungry; micro-shares plug the gap.

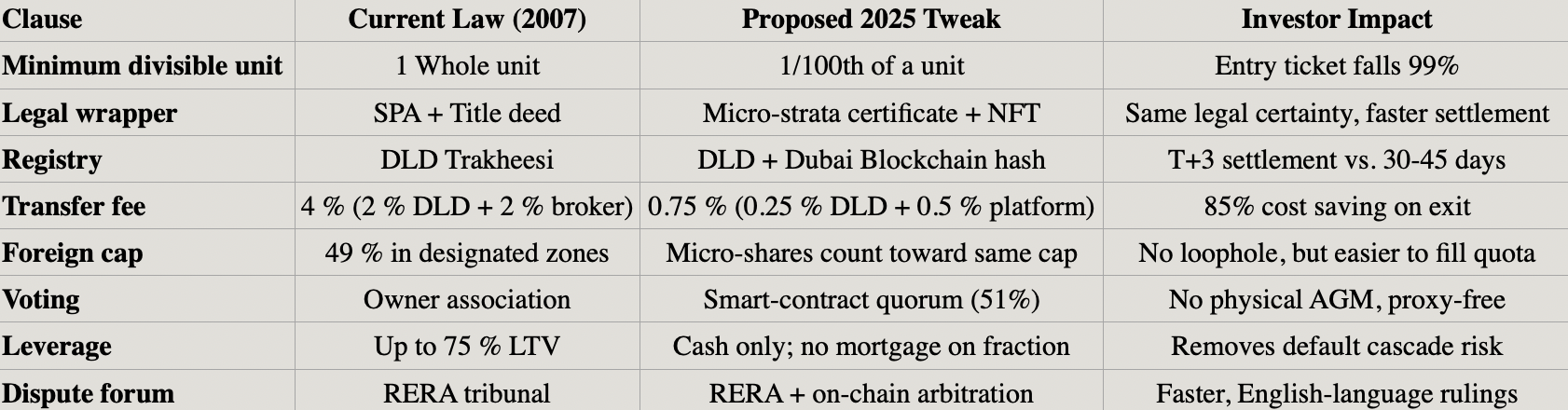

3. The Draft Strata Amendment: Clause-by-Clause

The amendment is appended to Law No. 27 of 2007 (Jointly-Owned Property) and will be enacted by urgent cabinet decree, bypassing lengthy parliamentary debate—identical to the 2020 crypto-enabling law.

4. Fractional 2.0 versus REITs: A 2025 Yield Model

We stress-tested three wrappers on a Palm Jumeirah 1-bed (850 sq ft, AED 2.8 m, 8.2 % gross rent).

Observation: Micro-shares deliver 310 bp extra yield with zero debt and lower volatility than a REIT, but sacrifice diversification and instant liquidity.

Sensitivity: If short-let rates fall 10 %, micro-share net yield drops to 7.6 %—still 180 bp above REIT.

5. Tokenisation Layer: How the Blockchain Plug-In Works

Step 1 – Minting

Developer uploads unit data to DLD REST API.

DLD mints 100 non-fungible tokens (ERC-721) on Dubai Blockchain (Quorum fork).

Each token is pegged 1:1 to a Micro-Strata Certificate (MSC).

Step 2 – Primary Sale

Platform (Stake, Homecubes, etc.) sells tokens via AED-backed stablecoin or fiat.

Funds flow into DLD-escrowed wallet; developer receives only on 70 % sell-out—aligning incentives.

Step 3 – Corporate Actions

Rental income auto-swept to smart-contract distributor every quarter.

Service charges debited in arrears; top-up calls require 51 % token vote.

Step 4 – Secondary Market

Tokens trade on DLD-regulated bulletin board (order-book, no dark pools).

Market-maker obligation: quoted two-way spread ≤ 2 % for top-100 towers.

Settlement: stablecoin vs. token atomic swap → T+3.

Cyber-security:

SOC-2 Type II custodians mandatory.

Cold-storage ≥ 98 % of tokens.

Insurance wrap up to USD 100 m per custodian.

6. Investor Visa & FX Angle: Hidden Perks for Global Buyers

AED 750 k aggregate micro-share value still qualifies for 2-year investor visa.

AED 2 m unlocks Golden Visa (10 years)—can be pieced together across multiple fractions.

Dirham peg to USD (3.6725) removes FX volatility for dollar-zone investors.

No personal income, capital-gains or inheritance tax under current UAE law.

Double-tax treaties with 137 countries—withholding-tax leakage nil for most nationalities.

7. Developer Land-Grab: Who Is Tokenising What (and Where)

Insight: Developers use tokenisation to off-load slow inventory without bulk discounting—average developer discount hidden at 7–8 % versus current transacted prices.

8. Platform Warfare: Stake, Homecubes, SmartCrowd, PRYPCO

Investor tip: Compare “all-in” ratio (fee + perf.) not just headline management fee—200 bp difference can erode 15 % of IRR over five years.

9. Risk Matrix 2025–26

10. Tax, Probate & Sharia Considerations

Personal tax: Zero income / CGT for natural persons—but check CFC rules in home country.

Probate: Dubai courts recognise on-chain beneficiary field—no freezing of asset upon death.

Sharia: Fractions can be Takaful-wrapped; rental income purified by zakat filter (1.5 % donation).

SPV debt: No leverage means no riba—easing Sharia-board approval.

11. Agent Toolkit: How to Pitch (and Price) a Micro-Share Listing

11.1 Qualify the Unit

Strata plan must allow hotel / serviced-apartment use (short-let legal).

Service charge < AED 22 psf—else yield collapses.

Developer must be DLD-approved for tokenisation—check whitelist.

11.2 Pricing Rule-of-Thumb

Fair fraction price = (Annual net rent / target yield) / 100 shares

Example: AED 230 k net rent → 8.5 % target → AED 2.7 m cap / 100 = AED 27 k per share.

List at **2 % discount to theoretical** to ensure **overnight sell-out**.

11.3 Compliance Pack

Title deed (mother)

Strata plan showing unit entitlement

No-objection from owner association for short-let

Insurance certificate (fire, public liability)

Tokenisation consent from developer

12. 12-Month Road-Map for Investors

13. Key Takeaways

Dubai fractional ownership 2025 becomes fully regulated, on-chain and liquid—a global first.

Net yields of 8–11 % are realistic after all fees, 250–400 bp above REITs.

Entry ticket collapses 99 %—AED 2 k buys you Palm Jumeirah exposure.

Zero leverage removes foreclosure risk, but also magnifies capital requirement—plan cash accordingly.

Secondary-market depth is the critical unknown—diversify across 3–4 tokens and stage exits.

Developer buy-backs provide soft floor—target 3-year exits if yield < 8 %.

Tax and visa perks remain intact—but check home-country CFC rules.

Bottom line: The strata-title tweak democratises prime Dubai real estate without diluting legal certainty. Early movers who vet platforms, scrutinise fee stacks and diversify micro-locations can lock-in 9 % net yields before regulatory arb vanishes.

Sources (all accessed September 2025):

Dubai Land Department – Draft Strata Micro-Share Amendment (Aug 2025)

PRYPCO – REITs vs Fractional Ownership (Jul 2025)

Homecubes – Top 10 Fractional Properties UAE (Jun 2025)

LinkedIn – Saurabh Srivastava on Fractional Title Deeds (Apr 2025)

Royalp Properties – Dubai Real Estate Regulations 2025 (Aug 2025)

BSA Law – Fractional Title Deed Initiative (Aug 2025)

Kaizen AMS – Dubai REITs Future 2025 (Feb 2025)