E-commerce Powerhouse: How Dubai’s Logistics & Warehouse Real Estate Keeps Outperforming

1 | Executive snapshot

Demand spike: new requirements for industrial / logistics space leapt 225 % in 2024 to ≈ 40.6 m sq ft and a further 11.5 m sq ft was logged in H1 2025.

Vacancy crunch: Grade-A vacancy is ≈ 3 %, while city-wide commercial vacancy hit a record-low 8.6 %.

Rents on a tear: Al Quoz Grade-A sheds reached AED 85 psf (+31 % y-o-y); Dubai Investments Park averaged AED 60 psf (+33 %).

E-commerce engine: UAE online GMV forecast to climb from AED 27.5 bn (2023) → AED 48.8 bn (2028) – an ≈ 8 % CAGR.

Supply bottleneck: just 780 k sq ft of true speculative space completes in 2025, yet 7.2 m sq ft is in the pipeline for 2026-28 (65 % already pre-let).

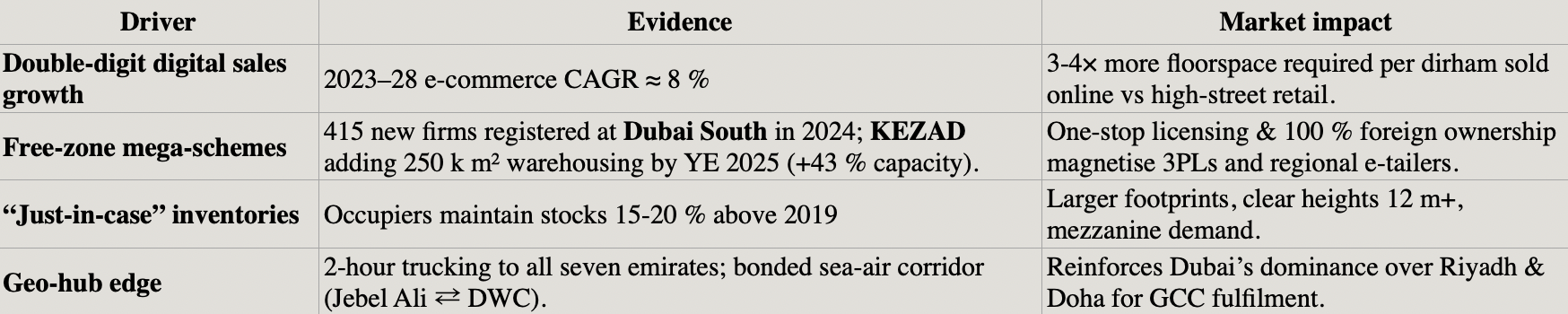

2 | Structural demand drivers

3 | Occupier trends (H1 2025)

Unit-size pivot: most enquiries now in the 25-50 k sq ft band, reflecting scarcity of mega-boxes and tighter inventory strategies.

Sector mix: logistics providers, manufacturers and retailers still account for > 50 % of all new requirements.

Cold-chain build-out: temperature-controlled stock in Dubai South fully pre-leased on delivery; F&B and pharma drive the queue.

4 | Supply map & rental benchmarks

Sources: Knight Frank H1 2025 Review & developer releases

5 | Capital-markets pulse

Investors closed AED 530 m worth of light-industrial assets in Abu Dhabi’s Al Markaz (Aldar ↔ Waha Capital) in Q2 2025 – signal of capital shifting up the risk curve.

Knight Frank notes rising bid depth for forward-funded cold-storage projects; prime yields edging below 8 % amid rental-growth outperformance.

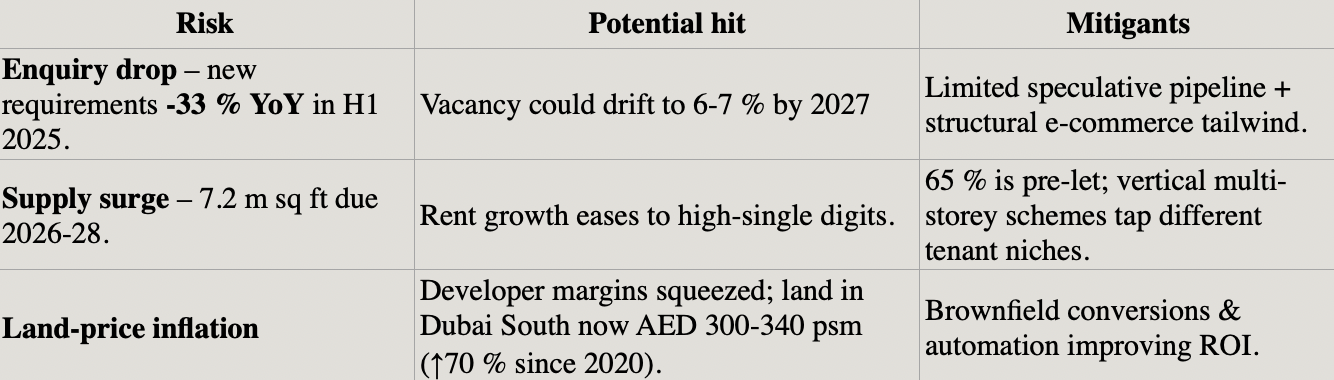

6 | Risks & what to watch

7 | Outlook to 2027

Rent trajectory: moderates to +7-9 % p.a. once 2026 bulk completions hit.

Cold-chain share: expected to exceed 25 % of new take-up by 2027.

Capital flows: anticipate entry of APAC REITs and GCC pension funds; first UAE logistics-focused REIT IPO widely rumoured for 2026.

Occupier strategy: dual-hub models (Dubai South + Northern Emirates) and urban micro-fulfilment centres become mainstream.

References

Knight Frank, Dubai & Abu Dhabi Industrial Markets Review 2024-25 (5 Feb 2025)

Knight Frank, Industrial Market Review H1 2025 (29 Jul 2025)

Khaleej Times, Commercial Vacancy at 8.6 % (17 Jul 2025)

WAM / EZDubai, UAE E-commerce to AED 48.8 bn by 2028 (17 May 2024)

Dubai South Media Office (3 Feb 2025)

KEZAD Group release (30 Jan 2024)

Knight Frank press brief, Rents to rise 2 % per month (5 Feb 2025)