The Green Premium vs. Brown Discount

How Sustainability is Reshaping UAE Property Values in 2025

Executive Summary

The UAE’s real estate market has reached an inflection point: sustainability now directly dictates asset valuation. Driven by federal net-zero mandates, ESG-focused capital flows, and occupier demand, LEED Platinum/Estidama 3-Star+ certified properties command 12–30% premiums across residential, commercial, and logistics segments. Conversely, non-compliant "brown assets" face value erosion of 8–22%, rising operational costs, and looming obsolescence. This report quantifies the financial impact through 2025 transaction data, analyses regulatory deadlines, and provides actionable frameworks for investors, developers, and occupiers to future-proof portfolios. Failure to adapt risks irreversible asset stranding.

1. Regulatory Catalysts: The Policy Engine Driving Valuation Gaps

Federal Net-Zero 2050 Mandate Enforcement

Carbon Tax Regime (MOCCAE Directive 2025-3):

AED 120/tonne penalty on buildings exceeding emissions baselines (phased implementation: 20% excess in 2025 → 5% by 2028).

Case Study: A 50,000 sq ft Class B office building in Deira emitting 30% above baseline faces AED 216,000 annual penalty by 2026.

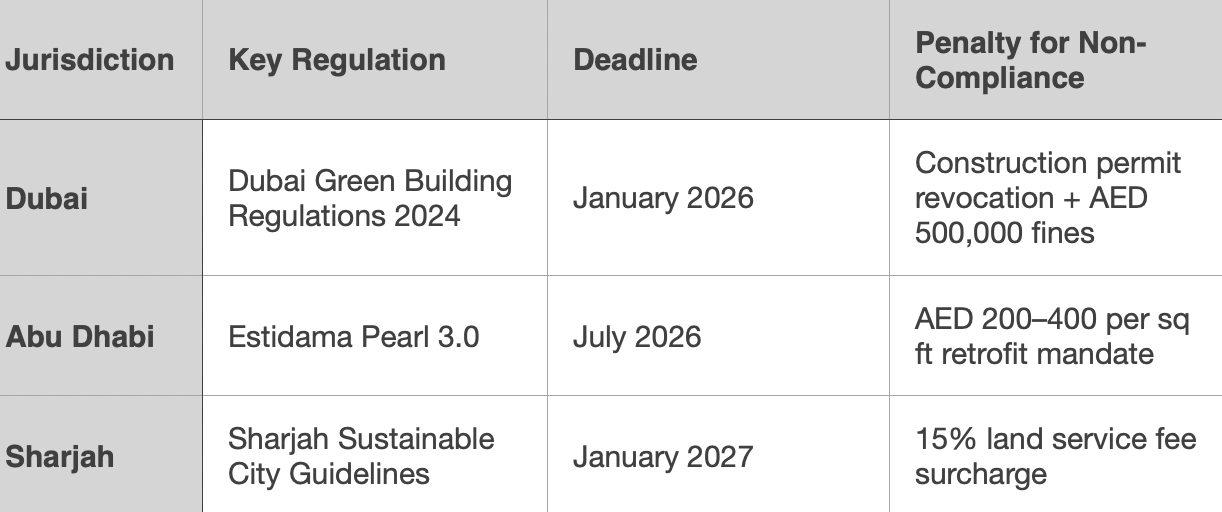

Emirate-Specific Compliance Timelines

Incentive Programmes

DEWA Solar ROI Accelerator: 9.2 fils/kWh feed-in tariff for surplus solar energy (vs. standard 29 fils/kWh consumption cost).

Verified Example: Dubai Hills Estate villa with 20kW solar system nets AED 12,300 annuallythrough energy resale.

ADGM Green Finance Hub: 0.75% interest subsidy for ESG-compliant project loans.

2. Market Data: Granular Analysis of Value Divergence

Residential Sector Valuation Shifts

Source: CBRE UAE Residential Market Watch Q2 2025, Developer Sales Reports

Brown Discount Evidence:

Older towers in Dubai Marina (e.g., Princess Tower) transacting at AED 1,150 per sq ft vs. AED 1,650 per sq ft for nearby Bluewaters Island ESG retrofits.

23% longer marketing periods for non-retrofitted villas in Arabian Ranches (Core Savills H1 2025).

Commercial Real Estate – The "ESG Flight to Quality"

Grade A Office Premiums:

DIFC: LEED Platinum towers (e.g., ICD Brookfield Place) achieve AED 2,450 per sq ft rents vs. AED 1,780 per sq ft in non-certified Burj District buildings.

Abu Dhabi Global Market (ADGM): Estidama 3-Star offices maintain 96% occupancy vs. 78% for Al Zahiya stock.

Logistics & Industrial:

DP World’s "Green Zone" warehouses (solar + EV charging) lease at AED 42 per sq ft vs. AED 36 per sq ft for non-compliant assets in Dubai South.

18% higher investor demand for cold storage facilities with thermal efficiency certifications (Knight Frank Logistics Report 2025).

3. Developer Innovations: Case Studies in Value Creation

Retrofit Success: Aldar’s Yas Park Gate Transformation

Project: 1980s office complex in Abu Dhabi retrofitted with:

AI-driven HVAC optimisation.

Building-integrated photovoltaics (BIPV).

Greywater recycling systems.

Results:

Estidama 2-Star → 4-Star certification.

Rental increase: 17%.

Energy costs reduced by 34%.

Occupancy rose from 71% to 92%.

New Build Benchmark: Nakheel’s "Net Zero Palm Jumeirah"

Sustainability Features:

District cooling using seawater heat exchange.

Recycled aggregate concrete (65% lower carbon).

Native xeriscaping reducing irrigation by 80%.

Market Response:

100% presales of Phase 1 villas at AED 3,850 per sq ft (vs. Palm average of AED 3,200 per sq ft).

HSBC provided 4.2% green construction loan (2.1% below conventional).

4. Investor Playbook: Capitalising on the Sustainability Arbitrage

Acquisition Filters for Premium Assets

Certification Minimums: LEED Gold / BREEAM Very Good / Estidama 2-Star+.

Technology Stack: Buildings with IoT energy monitors + automated systems (15% higher valuation resilience).

Location Synergies: Proximity to renewable infrastructure (e.g., Mohammed bin Rashid Solar Park).

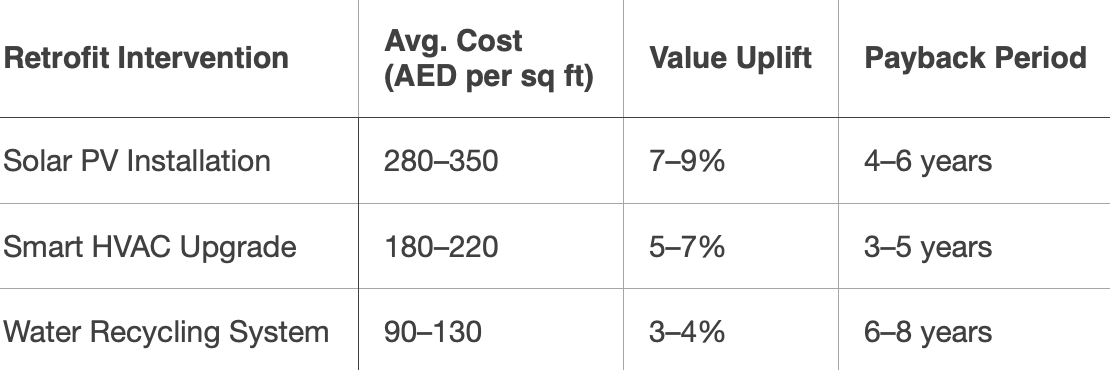

Brown-to-Green Conversion ROI

Source: JLL UAE Sustainable Retrofitting Study 2025

Divestment Red Flags

Buildings without energy audits conducted post-2023.

Assets in flood-risk zones (e.g., parts of Jumeirah Lakes Towers) lacking climate resilience upgrades.

Strata properties with >25% owner opposition to sustainability levies.

5. Occupier Strategies: Operationalising ESG Savings

Lease Structure Innovations

Green Lease Clauses:

Landlord-tenant cost sharing for efficiency upgrades (e.g., 60/40 split).

Energy consumption benchmarks with penalty/reward mechanisms.

Example: Mashreq Bank’s DIFC HQ lease ties 15% of service charges to actual energy performance.

Total Cost of Occupancy (TCO) Analysis

Note: 5-year lease term assumptions. Source: Cushman & Wakefield UAE Occupier Survey 2025

6. Future Outlook: The 2026-2030 Value Acceleration Curve

Phase 1 (2026): The "Compliance Cliff"

January 2026: Dubai mandates solar RWA for all buildings >5,000 sq ft.

July 2026: Estidama 3-Star becomes minimum standard in Abu Dhabi.

Impact: Non-compliant assets face immediate 10–15% value discount.

Phase 2 (2027–2028): Technology as Value Driver

AI-Optimised Buildings: Predictive maintenance reducing operational costs by 25%+.

Blockchain Energy Trading: Tenant-to-tenant solar power sales on decentralised ledgers.

3D-Printed Retrofits: On-site additive manufacturing cutting upgrade costs by 40%.

Phase 3 (2029–2030): Stranded Asset Crisis

Insurers withdraw coverage for non-net-zero buildings.

Banks cap LTV ratios at 50% for brown assets.

Projected Value Impact: Cumulative 35–45% erosion for non-compliant stock.

7. Critical Action Items

For Asset Owners (Next 12 Months)

Conduct energy audits using DLD/Estidama-certified assessors.

Secure green financing for retrofits before September 2025 ADGM subsidy deadline.

Divest non-upgradable assets in flood zones/older districts.

For Developers

Design: Integrate passive cooling, on-site renewables, and circular materials (e.g., EcoConcrete) from concept stage.

Construction: Utilise blockchain for carbon tracking (see Sharjah’s "Green Chain" Pilot).

Sales: Offer sustainability-linked payment plans (e.g., 5% discount on units achieving LEED Platinum).

For Government Entities

Accelerate brownfield retrofit subsidies.

Standardise ESG disclosure frameworks across emirates.

Link building permit renewals to energy performance certificates.

Visual Assets & Tools

Interactive UAE "Green Premium" Map: Layer transaction premiums over ESG compliance zones.

Brown Discount Risk Calculator: Input building age/location/certifications to quantify value erosion.

Policy Countdown Dashboard: Track emirate-specific compliance deadlines.

Conclusion

The UAE’s real estate market is undergoing a sustainability-led repricing that will redefine winners and losers. By 2027, "green" will cease to be a differentiator – it will be the baseline for asset relevance. Investors leveraging this transition through strategic retrofits, certified developments, and brown asset divestment will capture outsized returns, while laggards face irreversible value destruction. The data is clear: sustainability is now the core determinant of real estate wealth creation in the UAE.