1 Quarter 2025

1. Market Overview

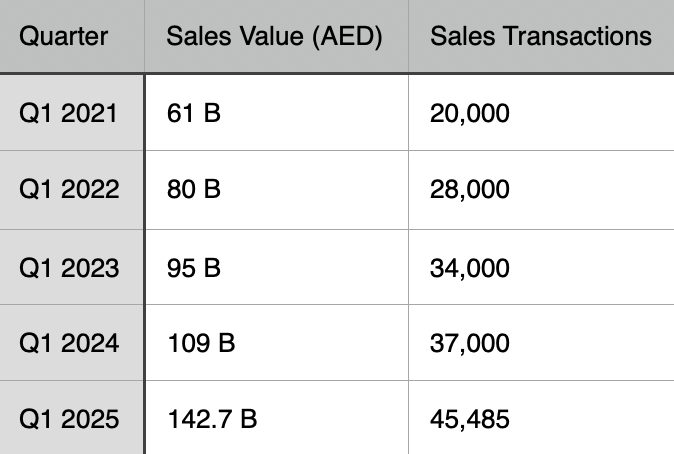

Total Transaction Value: AED 142.7 billion (~$38.85 billion)

YoY Growth: +30.3%

Quarter Rank: 2nd highest ever (trailing Q4 2024)

Total Sales Transactions: 45,485

YoY Growth: +22.8%

Key Insight: Strong quarterly performance signals resilience amid global uncertainty. The scale and pace of YoY growth across both value and volume reinforce confidence in Dubai’s real estate fundamentals.

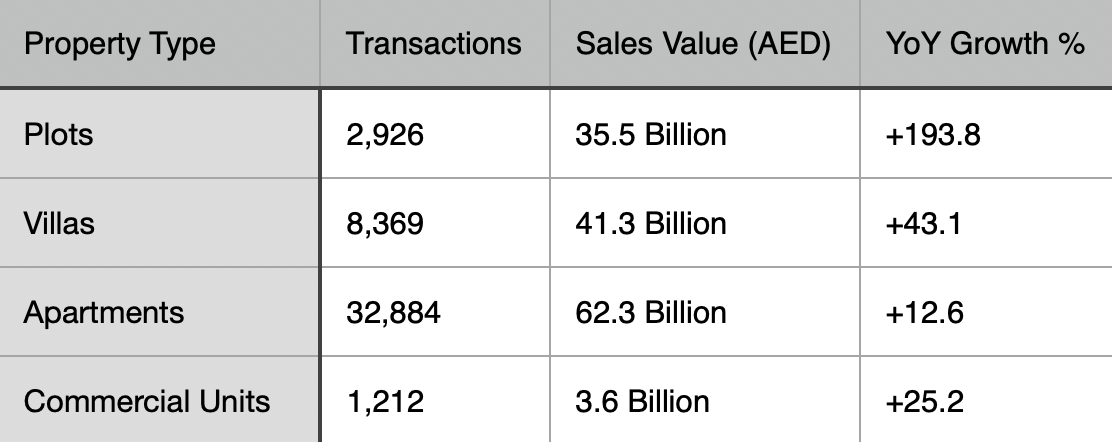

2. Segment-Specific Performance

Key Insight: Plot sales are the runaway leader in terms of growth rate, indicating a surge in land banking and development investments. Villas show demand shift toward more space and private property, post-pandemic.

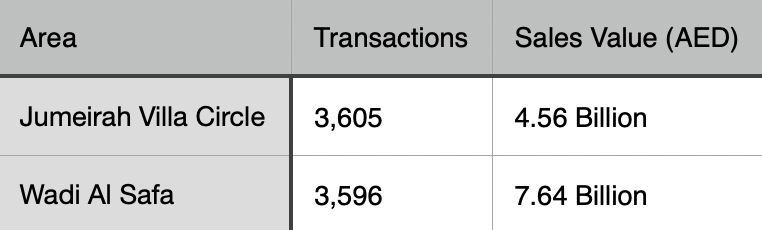

3. Geographic Hotspots

Key Insight: These zones combine affordability, location advantage, and strong development pipelines, making them attractive for both end-users and developers.

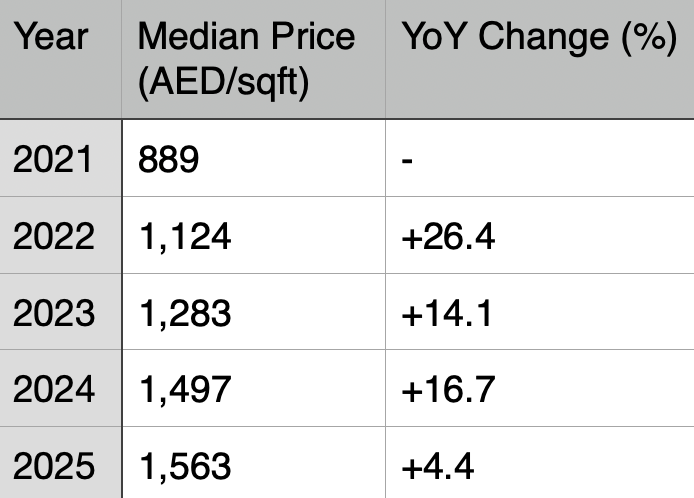

4. Pricing Trends & Dynamics

Key Insight: Price growth is moderating, signaling a maturing market with sustainable demand. This steady increase, rather than sharp spikes, reduces risk of a speculative bubble.

5. Investment Behavior & Off-plan Market

Off-plan Market Share: 65% of all sales.

Driver: High investor confidence in long-term viability of new developments.

Impact: Strong cash inflows to developers, increased launch of mega projects.

Key Insight: Investors are optimistic about long-term capital appreciation and are willing to commit to projects with multi-year delivery timelines.6. Luxury Segment & High-Net-Worth Trends

6. Luxury Segment & High-Net-Worth Trends

Growth in Homes >AED10M: +35% YoY.

Hot Zones: Palm Jumeirah, Emirates Hills.

Drivers: Wealth migration, global high-net-worth interest in residency & luxury lifestyle.

Key Insight: Dubai’s positioning as a global luxury lifestyle hub is attracting ultra-wealthy buyers from Europe, Asia, and the Middle East.7. Growth Drivers & Policy Influence

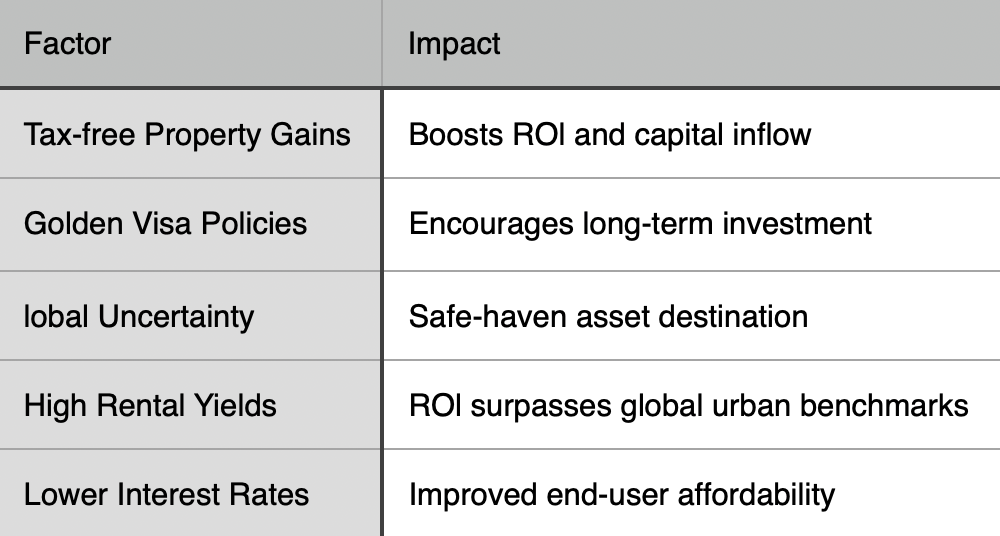

7. Key Growth Drivers

8. Comparative Historical Context

Key Insight: Dubai real estate has almost doubled in value over the past four years, demonstrating sustainable compound growth of ~23% annually.9. Forecast & Strategic Recommendations

9. 2025 Forecast & Strategic Recommendations

MARKET OUTLOOK

Expected Residential Price Growth: +5–10%

Continued dominance of off-plan and luxury segments

Expansion into emerging micro-markets like Dubailand, Dubai South, and Meydan

STRATEGIC RECOMMENDATIONS

Balance Portfolio: Mix of off-plan, luxury, and mid-tier resale properties for optimized ROI.

Focus on Infrastructure-Adjacent Zones: Areas near new transport projects or business hubs.

Monitor Regulatory Shifts: Stay alert to new incentives and residency-linked policies.

Sustainable Projects: Green-certified developments may gain premium demand.

Diversify with Commercial Units: Rising SME activity signals future demand boom in commercial spaces.